How Texas is Subsidizing Bitcoin Miners

Crypto bros aren't mining Bitcoin as much as they are mining Texas' grid

I lost track of how many times we were told to conserve energy last week. Texas was barely generating enough electricity to keep the air conditioners running. Texas has its own electric grid, so we can’t pull power from elsewhere in the country. When they set this up, no one imagined Texas would ever be running short of power. But when an ice storm hit Texas in February 2021 and froze the natural gas pipelines, the electric plants ran out of power, and so did millions of Texans. And just this week, another emergency was declared. If we didn’t turn down the A/C and quick, the whole grid might fail again.

Do you know how it feels to be governed by incompetent banana Republicans? When they screw up, we suffer the consequences, paying higher utility rates to bail out the utilities. Meanwhile, Texas’ one-party state never forced gas pipelines to be insulated or forced utilities to prepare for the completely surprising circumstance of it getting hot in Texas in August. We’re mad as hell, and we can’t do a damn thing about it except refuse to turn down the A/C in protest.

That was the headspace I was in when I saw my friend tweet a story from CNBC:

“I guess this qualifies as resolving the grid issue,” tweeted my friend Harvey. I try not to get angry about the news anymore, I really do. And I limit my news consumption as a nod toward better mental health. But I clicked the link for the article and read this passage a couple times, not believing that I was understanding the words correctly.

Riot said on Wednesday that it earned $31.7 million in energy credits last month from Texas power grid operator ERCOT. The company generated the credits by voluntarily curtailing its energy consumption during a record-breaking heatwave.

The total value of the credits dwarfed the 333 bitcoin the company mined in August, worth about $8.9 million dollars as of the end of the month.

Am I reading this right? We’re not only paying a bitcoin mining company to not mine bitcoins, but we’re paying them a lot more money than they make when they are mining bitcoin?

I’m also trying to tweet less these days, because the solution to what ails our national discussion isn’t more tweets from me. But I did it anyway.

“Because Texas didn't fix the grid, we're forced to pay bitcoin farms twice as much to shut down as they would make working,” I tweeted. “I can explain it to you, but I can't make it make sense.”

That’s when a bunch of crypto bros were only too happy to mansplain it to me.

“I can explain it to you, but I can't make it make sense.”

Let’s back up. Before the crypto bros give us their version of events, we need to come to an understanding of what the hell Bitcoin mining is, and to do that, we need to understand what in the entire hell a Bitcoin is. Bitcoin is a kind of cryptocurrency like Charmin is a kind of toilet paper, except people need the latter. Cryptocurrency is a digital currency backed by the full faith and credit of no country. You pay using cryptocurrency through encryption algorithms (AKA blockchain) outside of the (regulated, insured, and safe) banking system. It’s a bunch of ones and zeros that people say is worth something and can be exchanged secretly and privately.

And, like real money, the value of cryptocurrency rises and falls. For a while, Bitcoin, the most successful cryptocurrency, only rose, hitting a peak of almost $68,000 for one Bitcoin on November 8, 2021. If you squinted at the exchanges and crypto “lending platforms” and “native tokens” with a market capitalization of $34 billion, it could almost convince you that there was such a thing as a cryptocurrency industry.

The Giant 1980s Llama Boom in Central Oregon

I can see that you’re still confused. Maybe it would help to think of the Giant 1980s Llama Boom that took place in Central Oregon. My late grandmother was a rancher who raised quarter horses until one year she started buying llamas. Unlike horses, you couldn’t do anything with a llama. They were lousy pack animals, their wool was subpar, and they would spit at you. But all of a sudden female llamas were selling for $5,000, $15,000, $20,000 each. The prices kept going up! My grandmother liked the sound of that, so she bought some llamas and started playing Teddy Pendergrass down at the barn in hopes one of them would give birth to a whole lot of money.

As it turns out, the ever-increasing values were determined by two ranchers who would sell llamas back and forth to each other. Will you buy my llama for $15,000? Why sure, as long as I can sell it back to you for $20,000. Hey look the price for female llamas went up 33% this week! Oh, did I say the Great 1980s Llama Boom? I meant bubble. Soon you could get a llama for $2,000. My grandmother was left with tax write offs and surly llamas for years.

At least llamas were real.

At least llamas were real. When Sam Bankman-Fried was exposed as a fraud, the value of a Bitcoin lost more than $50,000 in a year. But unlike llamas, the tech bros who thought Bitcoin was their path to riches refused to admit that it was all speculative fakery. The cryptocurrency industry vanished, but people still trade Bitcoin like it’s a real thing. Now a Bitcoin will set you back about $26,000.

Underpinning the illusion of Bitcoin’s real value is how transactions are verified. According to Forbes, “Bitcoin mining refers to the process where a global network of computers running the Bitcoin code work to ensure that transactions are legitimate and added correctly to the cryptocurrency's blockchain.”

The computers do this by solving math problems. When a problem is solved, they get a Bitcoin, and the math problem gets more difficult. That’s Bitcoin mining. It used to be easy enough to mine for Bitcoins on your laptop, but the math problems now require so much computational power that huge factories are needed. One of the biggest in the country is in Rockdale, Texas in a former aluminum smelting factory.

“The tech industry we know today is what happens when certain received notions meet with a massive amount of cash with nowhere else to go.”

Would this sound less fake if I wrote “algorithms” instead of “math problems”? Cryptocurrency reminds me of Adrian Daub’s observation that “the tech industry we know today is what happens when certain received notions meet with a massive amount of cash with nowhere else to go.”

Sure, the dollar is a received notion as well, an imaginary concept made real only by mutual agreement that a green rectangle is worth whatever it says, and that’s backed by the full faith and credit of another agreed-upon hallucination, namely the United States of America. But what makes cryptocurrency more illusory is that its only value is that it can be exchanged for dollars. Cryptocurrency might be better understood as a vast digital art project, and all the crypto bros are part of the installation. They think they are disrupting the concepts of money and banking, but they’re not even in on their own joke.

Would this sound less fake if I wrote “algorithms” instead of “math problems”?

But the factories? Those suckers are real. After China kicked out Bitcoin miners in 2021, a lot of them moved to Texas where land is cheap, and they could lock in power at $20 per megawatt hour. “We have governors like Greg Abbott in Texas who are promoting mining. It is going to become a real industry in the United States, which is going to be incredible,” said one cryptocurrency expert. “Texas not only has the cheapest electricity in the U.S. but some of the cheapest in the globe.”

By June 2022, Bitcoin miners accounted for 2 gigawatts on the Texas grid. (Yes, this is more than the 1.21 GW that Marty McFly needed to get back to 1985 in Back to the Future.) Grid officials predicted that their power consumption would triple by this year.

Yes, but out of how many total gigawatts? On Aug. 10, the Texas grid set the high-water mark at 85 GW, which means that if Bitcoin miners account for 3 GW, then they are 3.5% of the power used in Texas. The Hoover Dam has a total capacity of 2 GW. A medium-sized city uses 1 GW. We’re talking about a lot of power in both senses of the word.

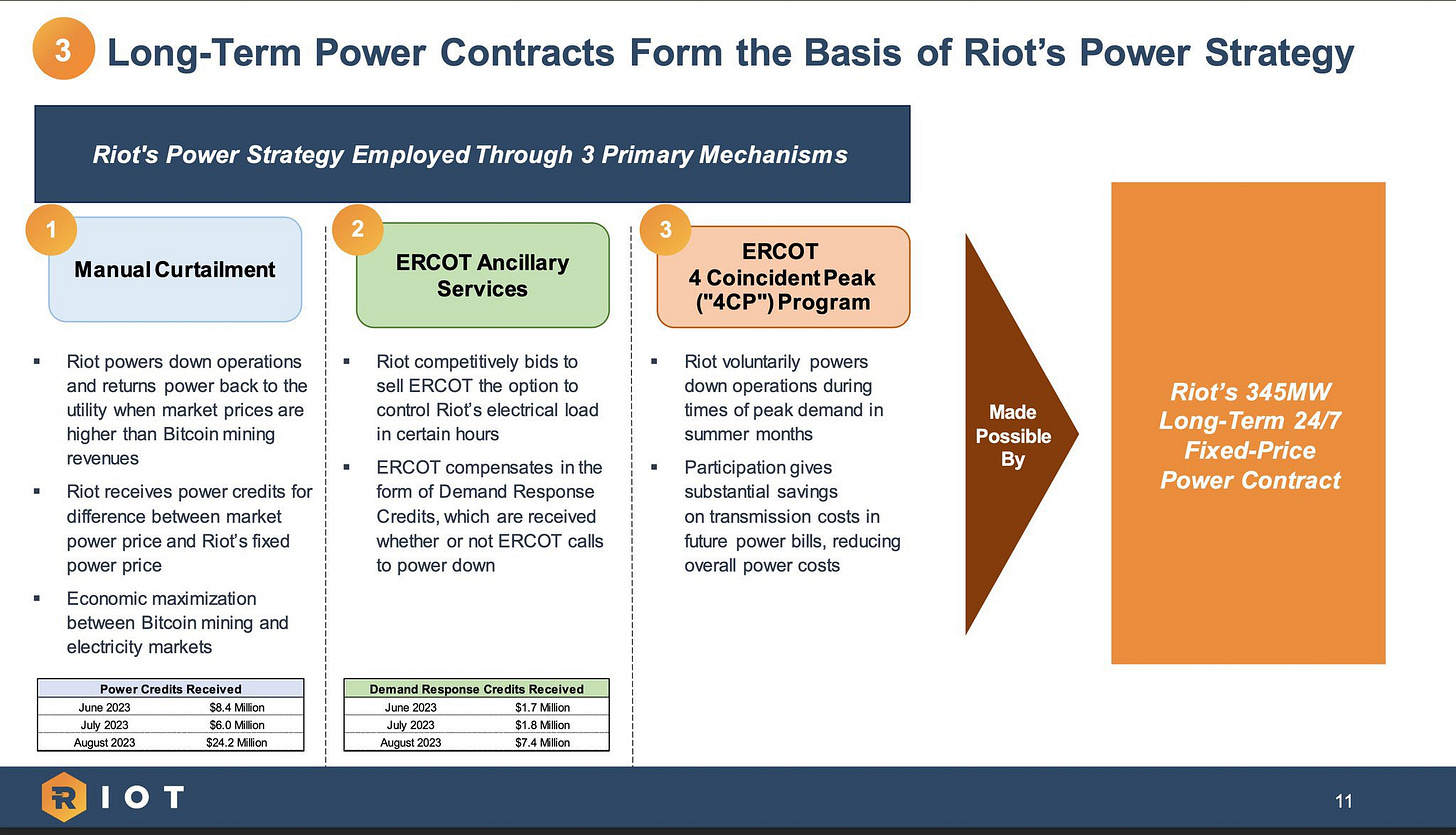

I wasn’t the only one cheesed off that crypto bros were profiting off our duct-taped electric grid that was begging us to back off the A/C for free. One dude named Pierre who pays for a blue checkmark replied, “It doesn’t make sense because of the spin.” It seems I had not considered what a smart financial strategy this was. For the Bitcoin miners. Committing hard to the bit, he mansplained me with a slide from a deck:

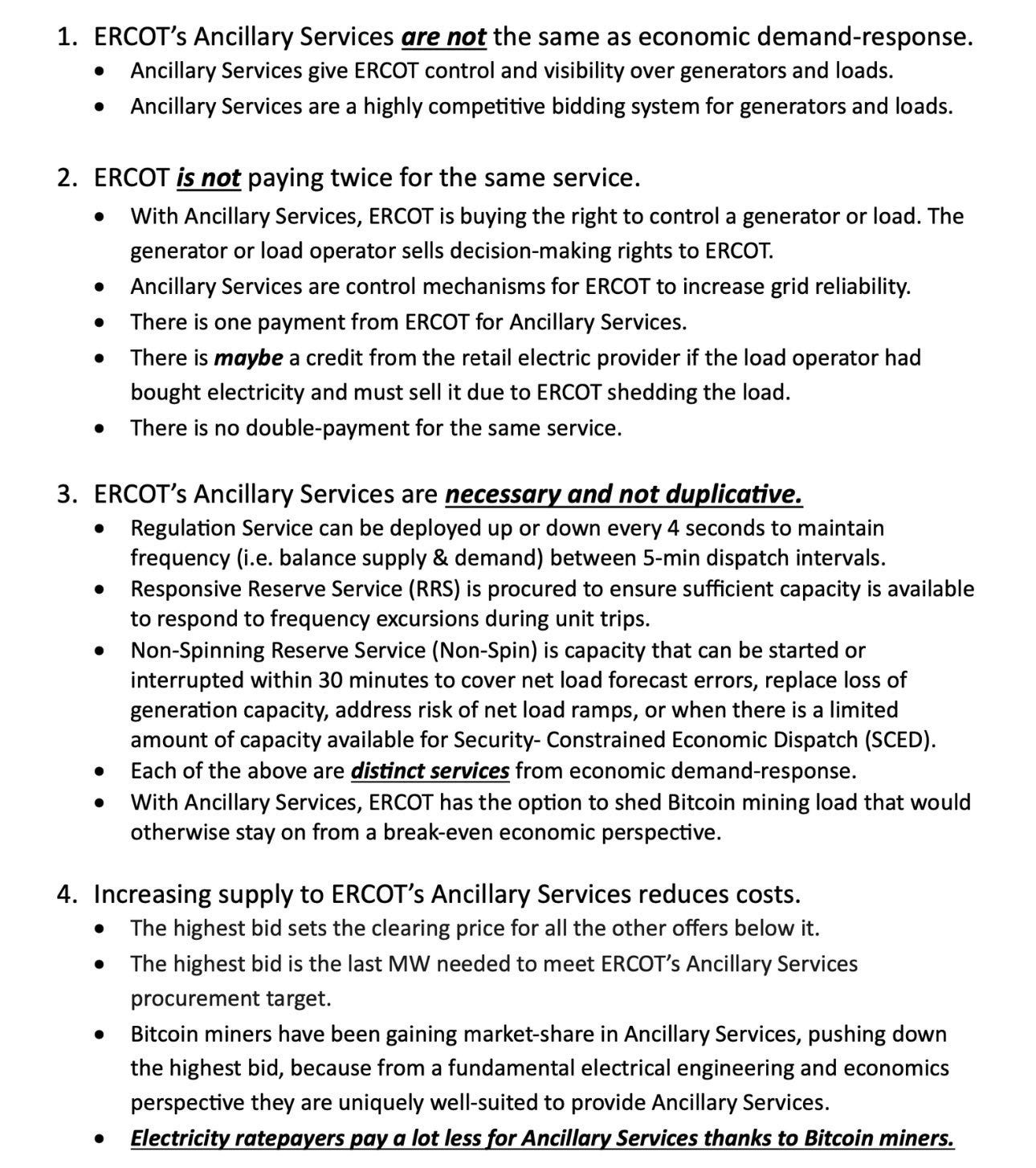

One man named Phil who calls himself a Bitcoin marketer made the ludicrous claim that “adding bitcoin miners to the grid so that energy producers can profitably generate more energy is the process of fixing the grid.” A guy named Lyle (who also pays Elon Musk $8 a month to verify his own identity) urged me to “learn how it actually works before commenting. Your A/C is on right now because of miners and these programs.” At least Lyle didn’t send me a Powerpoint slide; instead, he sent me industry talking points. Thanks, Lyle!

If your message is that “we’re not getting paid twice for the same thing,” you need to get a new rapid response plan.

***

Here’s the thing: The Bitcoin miners are such a huge drag on the system that when they do shut down, they can take credit for the grid not failing. And the ways they make money for doing so make some sense as far as keeping our A/C running. But that’s as far as I’ll go.

The Texas grid is based on scarcity, not reliability, producing only as much as needed, as I learned on KUT’s excellent podcast, The Disconnect: Power, Politics, and the Texas Blackout. There is not 3.5% slack in the system, which creates a power imbalance: ERCOT needs Bitcoin miners (more specifically, it needs their electricity) more than Bitcoin miners need power to solve math problems.

In fact, because cryptocurrency factories serve no public good and don’t actually produce anything, they are able to hand operational control over to the grid. ERCOT, which manages the grid, pays Bitcoin companies for the right to hit the off switch whenever it needs more power. Mind you, this is just for the right to do so. They get paid even if ERCOT never shuts them down.

They get paid even if ERCOT never shuts them down.

Also, ERCOT charges huge fees at peak demand, so the mining companies (again, serving no public good) can shut down when it suits them and avoid millions in fees. This is how the Bitcoin miners saved $62 million in 2022.

Remember how they bought power at cheap, locked-in rates? ERCOT doesn’t just charge big fees during peak demand. Prices can spike to $2,000, even $3,000 per MWH. These companies can resell their cheaper power for massive profits on the secondary market run by ERCOT.

None of that is, strictly speaking, wrong or illegal, though admittedly we’re not touching on the massive carbon footprint of Bitcoin miners, including how their existence incentivizes the production of fossil fuels. Right now we’re just focused on how these cryptocurrency miners extract money from our electric grid.

How much do these companies make employing what the CEO of one Bitcoin mining company called “our unique power strategy”? Above, we saw how this company made $31.7 million gaming the grid in August and only $8.9 million mining Bitcoin. In 2022, this company made $156.9 million mining cryptocurrency and $54.3 million mining ERCOT.

The crypto bros who clapped back at me had it backwards. Bitcoin miners aren’t keeping the grid up and running. It’s the other way around. Texas’ electric grid, with its low prices, incentives, and resale market, is essentially subsidizing the cryptocurrency industry. We begged our leaders to fix the grid, and I have to hand it to them. In a way, it is fixed, just not in the way that’ll do us any good. Maybe China had the right idea when they kicked these miners out.

Jason Stanford is a co-author of NYT-best selling Forget the Alamo: The Rise and Fall of an American Myth. His bylines have appeared in the Washington Post, Time, and Texas Monthly, among others. Email him at jason31170@gmail.com.

Further Reading

Screens

Welcome to The Experiment, where imitation is the sincerest form of irritation. The Atlantic has started a podcast with WNYC, which, neat, but they picked a name that is not quite their own: The Experiment. They say their podcast “will give listeners the context they need to understand our country right now,” which we perhaps mistakenly thought was thei…

In Real Life

I have a friend named Barbary who is smart about things I’m not, and she has the straightforward, knowing manner of a talented woman in a male-dominated field — in her case, tech — that I appreciate. And normally I’m happy to sit there and listen to whatever she has to say because when she talks I can feel myself get smarter and more aware, but this tim…

Kill the Unicorns

When did we start settling for reboots? Read: Lots of interesting stuff this week, including a gorgeous and heartbreaking Dan Zak piece on the one-thousandth day. Also: how to search better online, a great Chris Tomlinson column about global poverty, a terrific annotation of Greta Thunberg’s U.N. speech, why companies are offering tuition assistance, a g…

We set up a merch table in the back where you can get T-shirts, coffee mugs, and even tote bags now. Show the world that you’re part of The Experiment.

We’ve also got a tip jar, and I promise to waste every cent you give me on having fun, because writing this newsletter for you is how I have fun.

Buy the book Texas Lt. Gov. Dan Patrick banned from the Bullock Texas History Museum: Forget the Alamo: The Rise and Fall of the American Myth by Bryan Burrough, Chris Tomlinson, and myself is out from Penguin Random House. The New York Times bestseller is 44% off and the same price as a paperback now!

Leave it to Texas to one up Alabama. (Not a compliment). I thought the utility companies (Alabama Power..) the PSC and the coal companies had a cozy triad to milk the sheeple of Alabama, Texas takes it to a whole other level.

I don't want to use blue language here, so I'll just say FUCK BITCOIN MINERS