Trump f*d around. This week, we find out

On Friday, Trump will either keep up appearances or take the money and run

Welcome to the weekend edition of The Experiment, your official hopepunk newsletter. If you’d like to support my work, become a paid subscriber or check out the options below. But even if you don’t, this bugga free. Thanks for reading!

This week, Donald Trump will have to decide whether he’d rather be President again or keep being rich. He could end up as both, of course, but this week he’ll have to decide which he’s willing to risk, and on Friday we’ll find out.

Let’s start at the beginning, which for him was the end. In January 2021, he incited a mob at the Capitol. It was, as he promised, wild, and we’re still dealing with the consequences of the Insurrection, one of which was Trump getting kicked off Twitter for using the platform to attempt to overturn the election through violence. That was too far even for Twitter, at least back then.

Then Trump and a coterie of misfit lackeys created the Trump Media & Technology Group to fight back against what they saw as the liberal hegemony of Big Tech. And in Feb. 2022, they begat Truth Social, an anti-social media platform for the MAGA generation. Hoping to capitalize on an anti-woke backlash, Truth Social promised a virtual world where you can’t get cancelled for acting like, well, Donald Trump.

Truth Social promised a virtual world where you can’t get cancelled for acting like, well, Donald Trump.

They may have overestimated the market for people wanting to act like absolute asshats online—as well as the desire of companies to advertise to them. There is only one Black Rifle Coffee for a reason. TMTG had revenues of $3.4 million in first 9 months of 2023—and spent 10 times that much over the same period. The number of users went down 39% to only about 5 million active users. (Instagram, by contrast, has more than 2 billion active users. Even Elon Musk-era Twitter/X has 500 million.) This was a disaster for everyone including Trump, who reported earning less than $201 from TMTG in April 2023.

That’s not $201 million. It’s $200 and change.

On Feb. 24, 2024, Trump’s money problems got worse when he lost his civil fraud case involving him lying to banks to get loans. A judge ordered him to put up a $464-million bond while he appealed.

This became a problem when he tried to get a loan for the bond. Funny thing, when you get convicted of lying to banks to get loans, banks aren’t super excited to loan you money. Trump was turned down by 30 surety companies through four separate brokers before his lawyers pleaded with the judge that paying a $454 million bond was “a practical impossibility.” Even after an appeals court reduced the bond to $175 million, Trump pleaded illiquidity, earning Trump the nickname “Don Poorleone.”

At this time, good things were shaking out for Trump behind the scenes. We should have known something was up when he flip-flopped on banning TikTok, something he’d proposed but not accomplished as President.

One of TikTok’s largest investors is Jeff Yaas, the largest individual donor to federal campaigns in 2023-34. He calls himself a Libertarian, and like most Libertarians, he exclusively supports Republicans, including Texas Governor Greg Abbott, who used $10 million from Yaas to beat Republican House members in GOP primaries this year.

On Mar. 22—only 11 days after Trump coincidentally professed loyalty to Yaas’ TikTok—the board of another company for which Yaas is the biggest institutional investor approved a merger with Trump Media. And because the Yaas-controlled company had a Special Purpose Acquisition Company—it’s like an IPO waiting for a company to take public—suddenly Trump Media was just like a real, honest-to-goodness publicly traded corporation.

It even had a fancy ticker symbol: DJT. Donald Trump was literally for sale. Again.

Initially, DJT wasn’t a complete disaster, though what it actually was didn’t make itself clear. DJT hit a high of $79.38, and because Trump owned 60% of the company, this added $3 billion to his net worth, raising his overall holdings to $6.5 billion, making him one of the 500 richest people in the world. (A month later, earnout provisions gave him half again as many shares as he initially got, doubling his ownership stake in DJT alone to $6 billion.)

This new, magical source of wealth was not yet encumbered by judgments, liens, or lawsuits. Therefore, he could use the stock as rich people do—as an asset to use as collateral for a low-interest loan, in this case to pay his bond and remain a free man, if not an innocent one. On Apr. 2, he posted the bond.

“Trump somehow finds a way to sell to pay off criminal fines and then they all make bank from meme stock suckers who will pile in,” posted tech journalist and podcaster Kara Swisher. “Lather up, rinse down and repeat.”

If you or I had magically been made billionaires a few times over through stock machinations, our inclination would be to turn $6 billion in stock into $6 billion in cash gimme gimme gimme, please, and thank you. This is a normal reaction, which is why companies such as this have what are called “lockout provisions” that prevent me from selling a majority stake and immediately tanking my imaginary company.

“It’s the memeiest meme stock in Memeville.”

After he got the second batch of stock, Trump’s lockout provision kicked in. He wouldn’t be able to sell any stock for six months.

Meanwhile, some people started looking at Trump Media and wondering if there was anything behind the façade. “This is a company with $3.5 million in revenue that’s trading for billions of dollars in value,” said Swisher’s Pivot podcast co-host Scott Galloway, the business professor and investor who was among the first to notice WeWork was full of it. With some AI companies trading at 60 or 70 times revenue, Galloway noted that Trump Media was trading 600 times revenue. For every dollar that comes in the door, more than 10 go out. “There’s really isn't even a business here. This is not a business”

This is where it becomes difficult to separate the real from the riff raff. With Trump, as with Wall Street, it’s hard to tell what is real and what is representation, and with Trump it’s a safe bet to assume things are not on the level. But which lie are we being asked to ignore?

“It’s a scam of some sort,” said Swisher. “It’s a meme stock. But it’s the memeiest meme stock in Memeville.”

A meme stock is one traded by a coordinated group of small investors who often communicate with each other by trading memes on Reddit. Galloway pushed back gently, noting that other meme stocks such as AMC and Gamestop might be hyped by weirdos in their basements, “but they were businesses doing billions in revenue,” said Galloway.

“Even shorting it is a very dangerous situation,” said Swisher.

“My advice to anyone here is not to get near this thing,” said Galloway. “As far as we know he calls someone in the Gulf and says, ‘You know, I'll make sure that we buy oil from you, just do me a favor come in heavy.’ You're right, a small amount of purchases can send the stock skyrocketing.”

“It’s a meme stock or a way to funnel him money somehow,” said Swisher.

“He just has to call some guy and say buy a million bucks here and it’s the cost of doing business for people if he becomes president,” Galloway said. “It’s so corrupt.”

When Galloway blogged about the ludicrous delusions in WeWork’s SEC filings, he called the company’s pre-IPO $47 billion valuation “insane,” “seriously loco,” and “an illusion.” A month later his follow up piece, in which he wrote “Something is wrong. Something stinks. Something … Just. Doesn’t. Add. Up,” WeWork delayed its IPO.

This is not the case with Trump media. That Trump Media is so abnormal is being treated normally. I’m not trying to say Galloway’s assessments should guide markets, but he has a pretty good record for calling out BS on Wall Street where they play with real money. This isn’t politics. When a politician makes a willfully inaccurate statement in the congressional record, the worst that usually happens is that they’re dragged for doing so inartfully. People get sued for doing that on Wall Street for, again, real money.

What happens when a fake company exists in a real market? Do the fundamentals of the market groom the company with incentives to behaviors that build value for shareholders? Or do the flying monkeys bring their own funhouse mirrors to the trading floor so they can giggle at how big their poo looks when they fling it?

“It could go to a hundred if he’s elected president.”

DJT behaved exactly like a meme stock built to funnel money to Donald Trump. The more it looked like Trump would get re-elected President—and thus be in a position to encourage Russia, China, tech bros to invest in Trump Media—the higher DJT went. The more it looked like dude was cooked, the worse the stock did. DJT began tracking his polling numbers, up after the assassination attempt and down after Joe Biden stepped aside and further still now that Kamala Harris has pulled into a slight lead.

“You have non-economic interests in this thing, and it could go to a hundred if he’s elected president,” said Galloway.

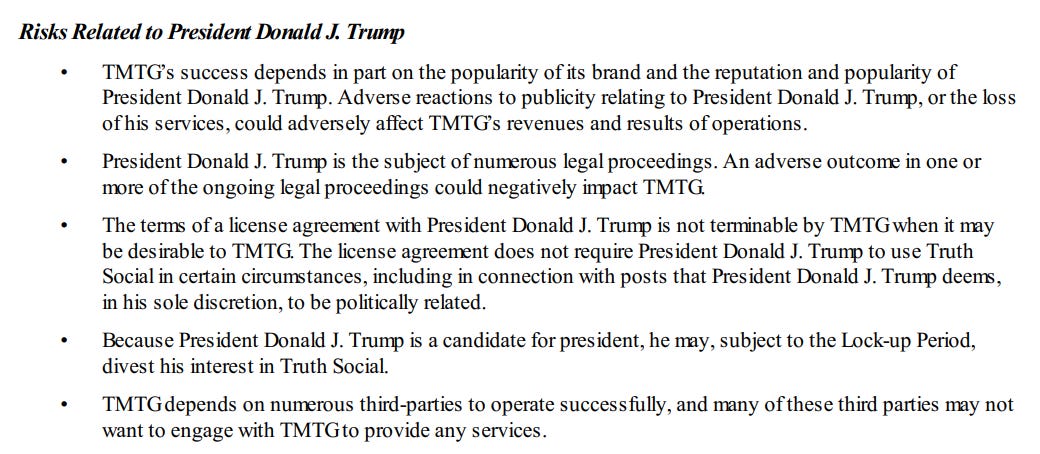

Trump Media’s SEC filings admit as much that the company’s fortunes are tied to those of Trump who, the company admitted, presents many risks. “Adverse reactions to publicity relating to President Donald J. Trump,” disclosed the company, “could adversely affect TMTG’s revenues and results of operations.”

Meanwhile, actual business is being transacted. I mean, sort of. In the second quarter Trump Media lost $16 million against $1 million in revenue. The stock is down a third in the last month, including 10% since he ranted in the debate about Haitians eatings pets. As of Thursday, Trump’s shares were worth approximately $1.85 billion, which now means he’s only the 851st-wealthiest person in world, and that might make him a billionaire a few times over, but his liabilities outweigh assets by $50 million.

Trump is a very rich kind of broke, he’s lost his lead in the presidential race, and now the lockout period is about to expire on Thursday as long as the stock is trading above $12. Starting Friday, he could sell all his stock and make perhaps up to $2 billion dollars, which inevitably would tank the stock of a company that functionally only exists to put billions into his bank account.

On Friday, Sep. 13, Trump held a press conference at the Trump National Golf Club at Rancho Palos Verdes outside of Los Angeles, and he was asked if he planned to sell his stock in Trump Media when the lockout expired.

“No, I’m not selling. No, I love it,” he said.

“I don’t wanna sell my shares. I don’t need money,” he added.

“I absolutely have no intention of selling,” he said.

“I don’t need money.”

After saying he would not abandon his totally real, not a scam company, shares rose as much as 29% and ended the day up 11.8%.

“This guy is going to sell most or all of it because he's going to look and go there's nothing here. He knows there's nothing there,” predicted Swisher last spring, who also predicted that doing so would trigger a wave of lawsuits that would turn up “emails everywhere because they’re so cloddish at their corruption.”

Trump is facing a difficult choice, but his promise not to sell is worthless. In fact, him saying X is usually a reliable predictor of Y happening. But let’s go through his options:

If he wins and doesn’t sell, he makes billions either way and gets to pardon himself.

If he loses and doesn’t sell, he gets nothing except plea bargains, fines, legal bills, and possibly an orange jump suit.

If he sells now, he will have a legit billion-plus dollars in the bank and still a chance to become president.

On Friday we find out, but I am unpersuaded that Trump is trapped any more than he was when he couldn’t raise the money to pay his bond. All I’m willing to state is that this looks like late-stage Trumpism, comically warped and janky, with no one quite knowing what’s real and what isn’t.

“The fact that you’re mixing Donald Trump, social media, and meme stock is peak 2024. This guy, as always, has found a way out,” said Swisher. “He’s gotta be the luckiest f*ck in America.”

Jason Stanford is a co-author of NYT-best selling Forget the Alamo: The Rise and Fall of an American Myth. His bylines have appeared in the Washington Post, Time, and Texas Monthly, among others. Follow him on Threads at @jasonstanford, or email him at jason31170@gmail.com.

Further Reading

We set up a merch table in the back where you can get T-shirts, coffee mugs, and even tote bags now. Show the world that you’re part of The Experiment.

We’ve also got a tip jar, and I promise to waste every cent you give me on having fun, because writing this newsletter for you is how I have fun.

Buy the book Texas Lt. Gov. Dan Patrick banned from the Bullock Texas History Museum: Forget the Alamo: The Rise and Fall of the American Myth by Bryan Burrough, Chris Tomlinson, and myself is out from Penguin Random House. The New York Times bestseller is out in paperback now!

Trump is the ball in the shell game. Which walnut shell is he under?But he's long since palmed himself, pardon the expression. There's nothing under the walnut shells. There is no money. There is no Trump. Just the con.