This is the worst recession ever. For starters, it's not even a recession.

Why do we believe we're in a recession when the economy keeps booming?

The other day, more than 3,000 miles beneath our feet, Earth’s inner core started spinning in the wrong direction. Normally, we’re all spinning on Earth’s axis from west to east, and the core does right along with it, which frankly I don’t think is too much to ask. Scientists called this “surprising.” The friend who posted this news on our chat called it “creepy.” Then, a month later, part of the sun broke off and formed a vortex, which sciencealert.com called a “weird little polar tizzy” that was “nothing to be alarmed about.” Clearly, we are all about to die.

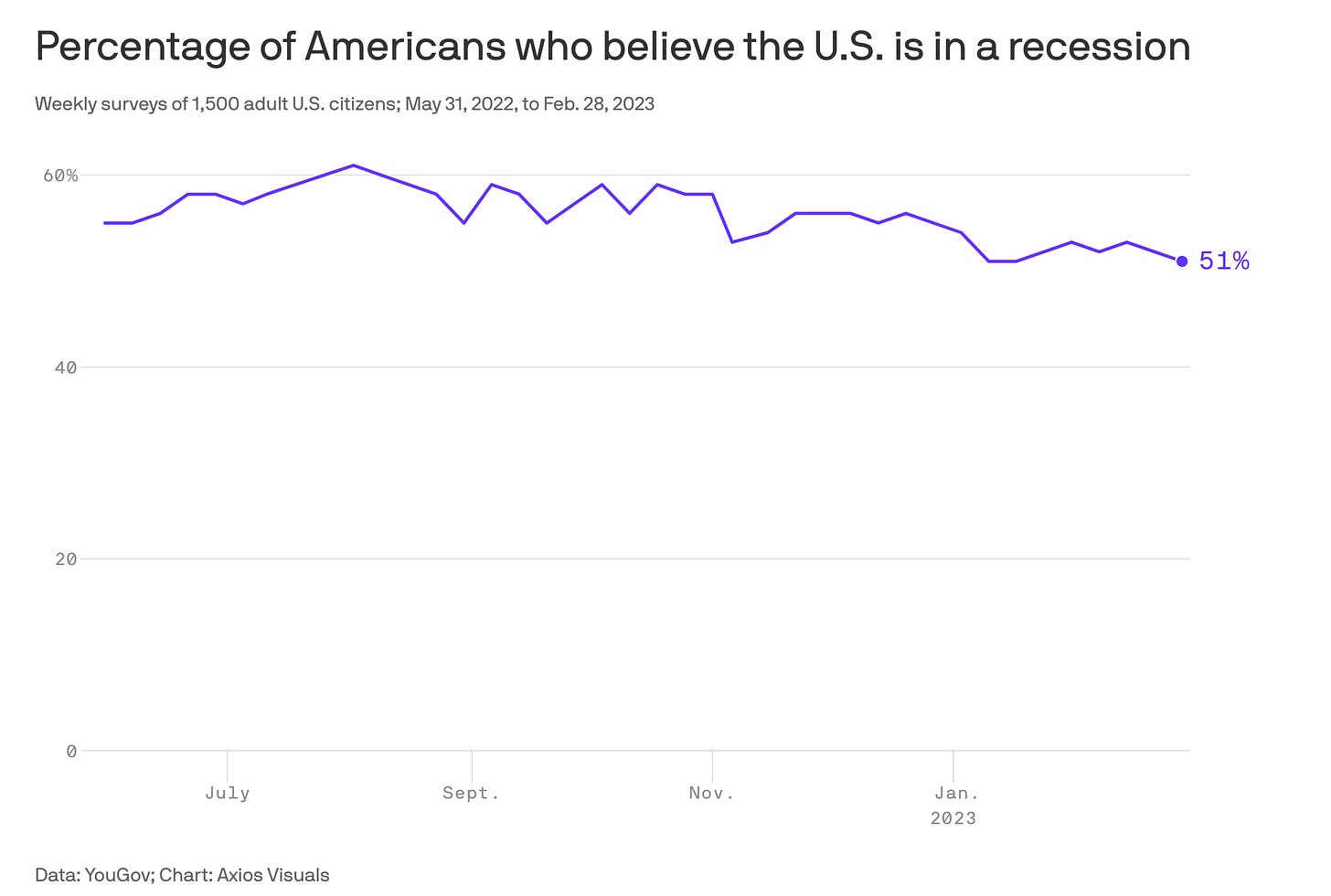

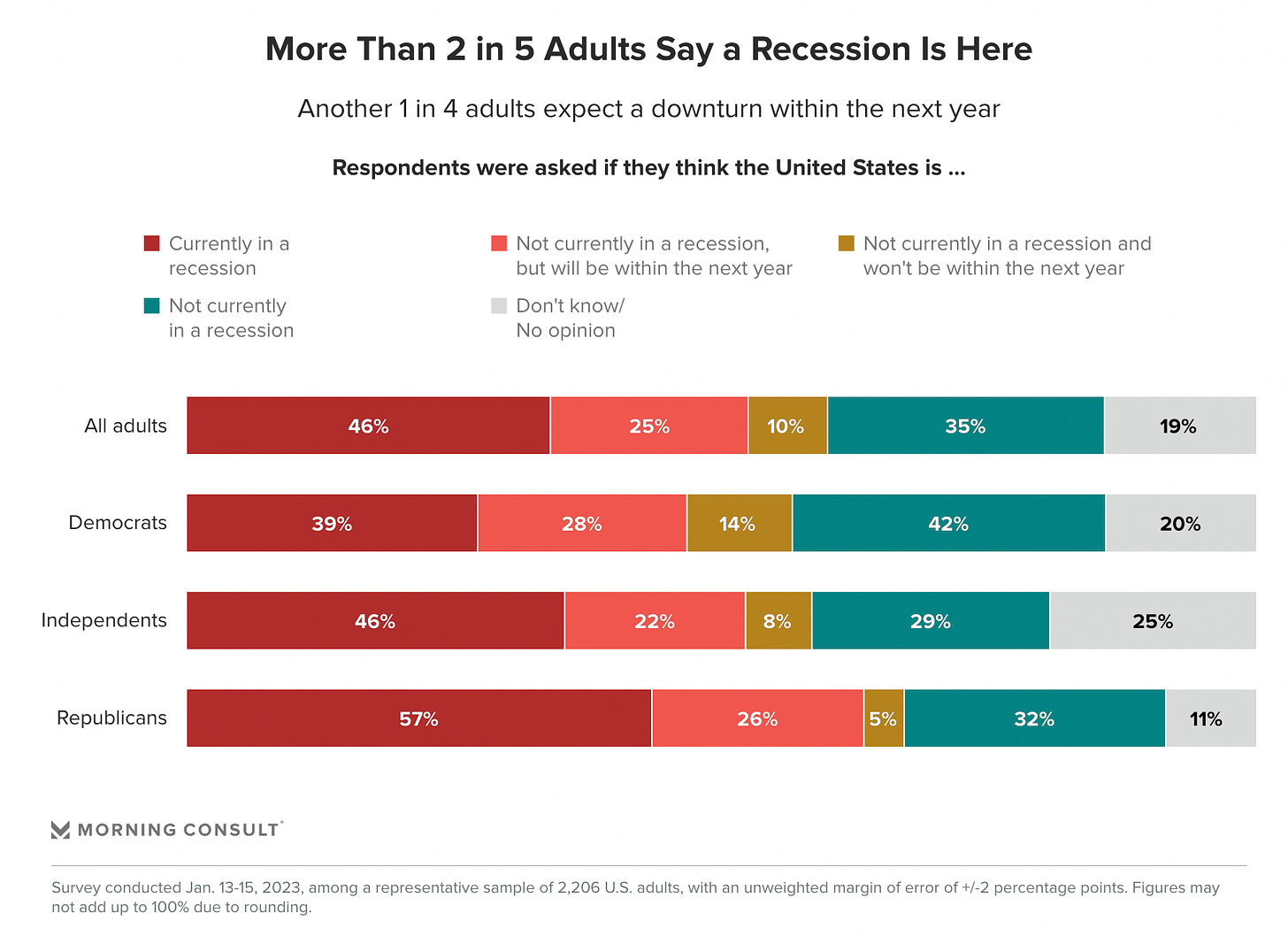

A similarly fatalistic outlook has infected a majority of my compatriots, who insist beyond reason that our economy is in a recession.

Americans are more likely to believe we are in a recession than believe we are living in the end times, which I suppose might not be unrelated. Bad example. Let me try again. Americans are more likely to believe the economy is in a recession than believe in the American Dream. OK, another bad example. One last chance? I think this one is good. Americans are more likely to believe that we are in a recession than that ghosts and demons exist. Ah, nevermind. I’ll come back and delete this paragraph later.

Actually, don’t tell anyone, but things are pretty darn good, thanks for asking. One journalist called this the “stealthy 2023 economic boom,” and boy let me tell you, there are things going on that sound Very Important. People are spending money, it seems. And the last time the unemployment rate was this low was before I was born, and brother, I was born during Richard Nixon’s first term. Heck, a six-month Treasury security surged above 5% this morning for the first time since 2007. I mean, I have no idea what that means, but it sounds important.

You don’t even have to hunt very hard to find good news about the United States of America these days. Scott Galloway did, and look what he found!

The numbers are clear: incomes and jobs are beating expectations, personal savings is rebounding, core inflation is at its lowest point in two years, and the recession has been kept at bay. Let’s say this again, quoting an actual, by-god economist: “[H]igh inflation in the US and the Euro area is over. We are back at 2%.”

Heck, the United States government has even re-created the sun. Our leadership and diplomacy has checked Russia in Ukraine. We are energy and food independent, our stock market is outperforming China’s by a lot, and we’re not suffering anywhere near the pain that our German and British friends are, and as Galloway is fond of pointing out, “Nobody is lining up for Chinese or Russian vaccines.”

And yet, what are the headlines trumpeting about this seeming economic turnaround? “Economy grows, even as U.S. braces for recession,” says Politico. “The month of January 2023 has already seen more tech layoffs than the entire first half of 2022 combined,” reports Insider. I opened the business section of The New York Times today. The articles talked about fat corporate profits and strong consumer spending; the headlines talked about economic gentrification and a “downbeat outlook.”

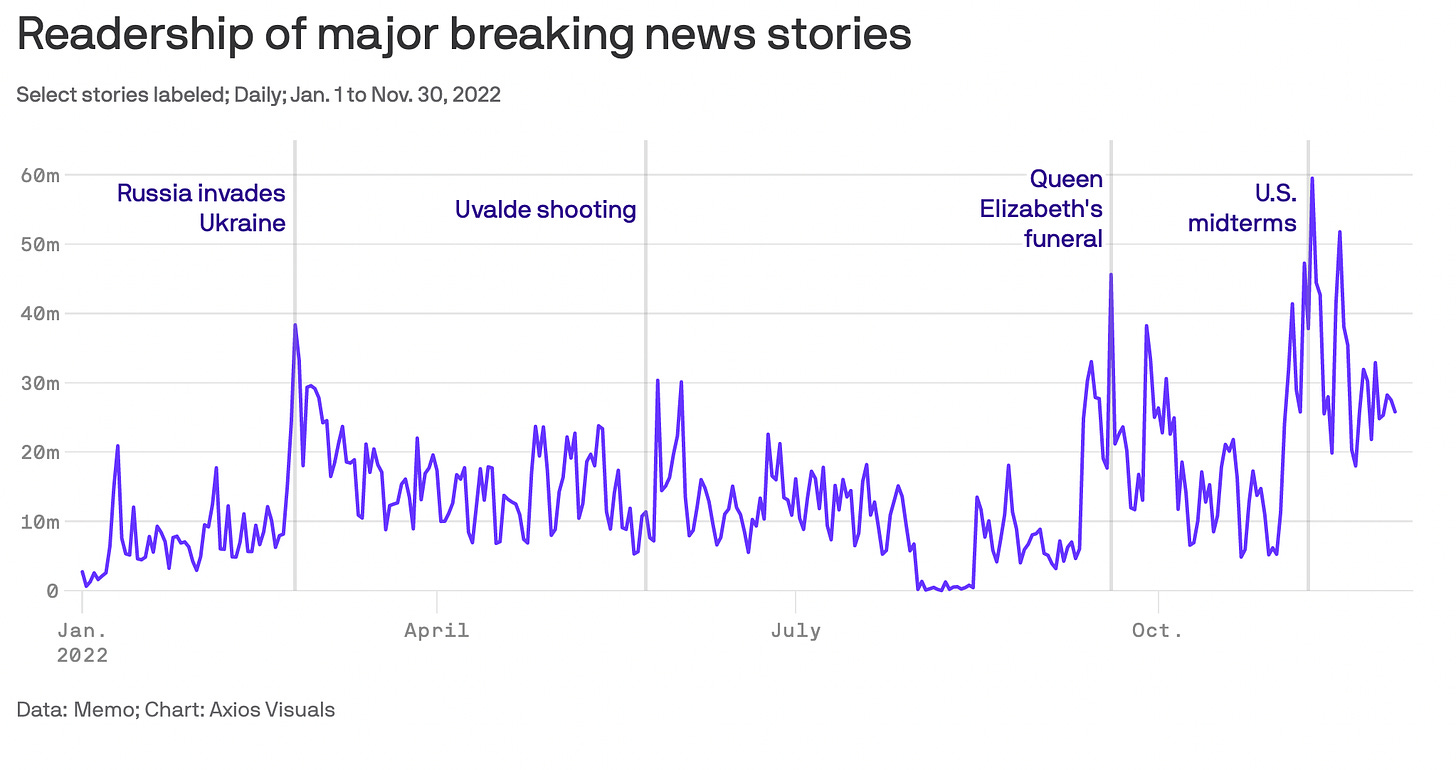

To be fair, The New York Times is also a business that depends on subscriptions and advertising, and the more people who read their stories, the more they can charge for advertising, and the more people who subscribe. Step three is profit, and if last year is any guide, they don’t reach step three unless there is bad news.

Hold on, stop, wait a minute… A lot of the people who subscribe to this newsletter are the rarest of breeds: working journalists. And when this argument arises — that bad news sells — their instinctive reaction is to dismiss allegations that the news media intentionally covers bad news to boost their bottom line. Heck, that’s my reaction, too. But I’m not saying that The New York Times or any other news media organization this side of Fox News intentionally hypes bad news for ratings.

What I’m saying is that news media consumers gravitate to bad news. Headline writers know this. There are even websites that tell you how likely your headline is to engage your audience or make an impact. And “Economy basically fine: Earnings better than expected as retail sales to grow modestly” registers below average engagement, while “Retailers Lay Out a Downbeat Outlook as Inflation Squeezes Low-Income Shoppers: Despite better-than-expected earnings, retail executives predict that any sales growth will be much smaller than in years past” — which was an actual NYT headline this morning — makes an above average impression.

The real business crisis here is journalism, which has recently seen a bunch of layoffs. Even the Washington Post, which is owned by a dang billionaire, cut 20 people loose in January. To get to step three, news outlets need you to read their stories, and according to a recent analysis of news consumption, well, you know…

Bad news also drove business coverage. As conversations around inflation and a potential recession rose, so too did readership of news about business leaders — which saw an increase of 94% according to an analysis of how we consume media.

And that’s part of the reason about as many Americans believe that our economy is in a recession as they do in the Big Lie that Joe Biden stole the 2020 presidential election. Shoot. Another bad example. Y’all, I’m gonna figure this out before too long, but the simple fact is that the reason we’re not in a recession is that people are buying cars, furniture and electronics, and meanwhile 96% of us are looking for ways to save money. Consumer spending is keeping us out of a recession, and the consumers doing so are worried that we’re in a recession. We’re saving, but splurging. Maybe the comparison to belief in the Big Lie wasn’t so bad after all.

Here’s what I think is going on: the top half of earners are sitting on a mountain of cash — more than $1 trillion — they saved during the pandemic. And the bottom half spend what they have, what they’ve saved, and what they can put on a credit card. The haves are scared — layoffs in tech hit them the hardest, for example — and their concerns drive news coverage. The have-nots, while hunting for deals and dips in gas prices, don’t have the option of not buying groceries or gassing up their cars. Investors get worried and spook the stock market. Working class consumers get worried and go to Walmart anyway.

There’s another thing I think is going on. Wages for part-time and full-time workers rose 6.3% last year, for hourly workers slightly less at 4.9%. A fella flipping burgers was making minimum wage not too long ago. Now the marquees at fast-food joints advertise wages of $12 an hour, more sometimes. Suddenly, working-class folks have a little more money which they are spending at McDonald’s and Taco Bell. Why they might even splurge on a night out at Red Lobster or Applebee’s, which are suddenly doing well again. Might even see if there’s something that fits over at Burlington, which is beating Wall Street’s expectations and snatching up locations left vacant when Toys ‘R’ Us or Linens & Things go out of business.

The heroic working class is saving America from a recession one Big Mac at a time.

We’re not reading headlines about the heroic working class that is saving America from a recession one Big Mac at a time. Part of that is due to our dumb brains that seek out bad news, mistaking clickbait for a wolf’s eyes glowing in the campfire light. Part of it could be due to what an investigation into business journalism by the British Broadcasting Company concluded was a “lack an understanding of basic economics or [of] lack confidence reporting it,” like this idiot.

But the most insidious thing about business journalism is that investment bankers get quoted more than people who know where the cheapest gas is. You need a master’s degree to get a job in top newsrooms these days, and there are less and less of those all the time, both newsrooms and jobs.

So you end up with a bunch of smart journalists with bootstrap stories that invariably include bragging about eating ramen in college dorms writing about people who still eat ramen but don’t brag about it. You end up with us, the people who are irritated about eggs costing a lot, writing about them, the people who eat fewer eggs when they get too expensive. And because it’s those people, over there, in neighborhoods we call “underserved” but they just call poor, that we fail to see what is happening right in front of our dumb faces.

Poor people are saving us from a recession. Let’s pay them more money by raising the minimum wage and see if that helps. Who knows, maybe paying people more for work could get the Earth’s core spinning in the right direction. Might even save us from the solar vortex.

Jason Stanford is the co-author of NYT-best selling Forget the Alamo: The Rise and Fall of an American Myth. His bylines have appeared in the Washington Post, Time, and Texas Monthly, among others. Follow him on Twitter @JasStanford.

Thanks to Noom, I lost 40 pounds over 2020-21 and have kept it off since then. Click on the blue box to get 20% off. Seriously, this works. No, this isn’t an ad. Yes, I really lost all that weight with Noom.

We set up a merch table in the back where you can get T-shirts, coffee mugs, and even tote bags now. Show the world that you’re part of The Experiment.

We’ve also got a tip jar, and I promise to waste every cent you give me on having fun, because writing this newsletter for you is how I have fun.

Buy the book Texas Lt. Gov. Dan Patrick banned from the Bullock Texas History Museum: Forget the Alamo: The Rise and Fall of the American Myth by Bryan Burrough, Chris Tomlinson, and myself is out from Penguin Random House. The New York Times bestseller is 44% off and the same price as a paperback now!

One of your best